In Black tax, you don’t have unnecessary channels

Arrivalism: Ugandan corporates, the elites, and other chaps that belong in the arrivalism club have a habit of dodging their civic duties. They have all kinds of excuses for dodging the black tax. Today, we shall take time to educate these ungrateful chaps about the greatness of the black tax system, how it works and why they ought to be compliant.

Black Tax

Black tax is everywhere, it can never be destroyed, it is the foundation of our ‘Ugandaness’. You know you have made it in life based on how your pocket measures up to its daily demands. If you spend a week without a call from a relative, then you are still in the lower black tax bracket. A true Ugandan citizen pays their black tax on time as and when called upon. When it comes to black tax, you must avoid excuses such as; “let me see what I can do” or “call me back later”. Black tax is supposed to be an instant payment.

But unlike the official tax system, when it comes to black tax, the recipients are the tax collectors. There is no duplication of roles. In a normal system, the revenue authorities collect the tax, send it to the government and then the government appropriates the money. In black tax, you do not have unnecessary channels. If a snake bites your relative, you do not wait for a committee to approve the payout, you simply channel the money to your relative. There is only one way to dodge tax, and that is by becoming a collector. Organise a non-existent wedding or function and ask your relatives to contribute. Then no one will bother you for the rest of the year.

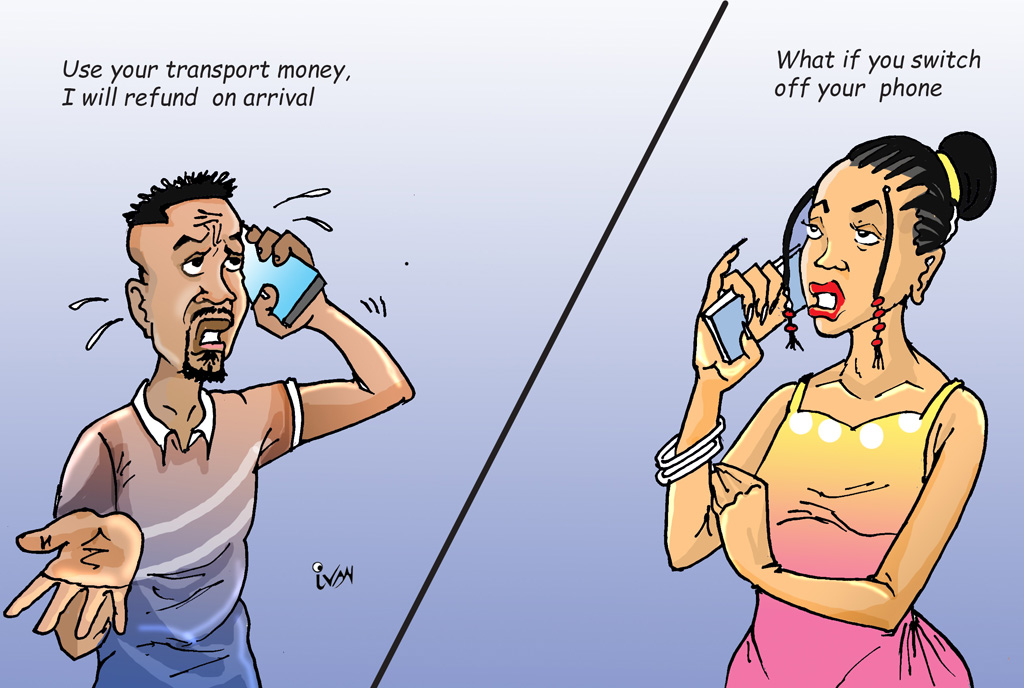

Transport money

Transport money is the evolved version of black tax, except that it has favoured one gender. Unlike other forms of black tax, the collectors of transport money have sometimes proven to be jumpy. As such, going forward, transport money should only be paid on arrival. The collector, aka the recipient, must register their presence before arrival. Of course, it is a double-edged sword. The collectors have often asked; “What if I use my own money then you switch off the phone on arrival?” In a world of filters, the taxpayers want to see before they pay, yet the recipients want to be paid before they are seen.

Know your relatives

As part of its corporate social responsibility, black tax ensures that its taxpayers can easily trace their relatives. It is often said the poor man is the only man without relatives in Uganda. If you have some ka money, you do not need to find your relatives, they will find you. They will introduce themselves to you. “Hey Brian, you know it is me who used to scratch your legs when you were still a baby.”

The blackmail

Black tax works through blackmail. One is blackmailed through a series of well-calculated stories. The stories are always a simple way to coerce you into making that payment. They will remind you of the friendship they had with your distant grandfather. That if it were not for that friendship, you would probably not exist. If it means to cry, the black tax collector will cry on the phone. They will assure you that if you do nothing, someone is going to die, that someone will not eat food that day.

The black tax collectors do not care about you. Whether you are sinking in loans or not, if we see you driving a car, then you are eligible to pay tax. And the collectors will inform the circle of collectors about this new recipient. Each recipient will convince you that their problem is mightier. “You know I want some capital to grow my business. I will pay you back”. Never believe in this illusion of being paid back. In black tax, there is nothing like a loan. As a black taxpayer, you will be pressured to pay school fees for children you did not sire. The father of the kids, the ultimate purveyor of the enjoyment, will boldly call you out; “Mukama wange, the children have to return to school”.

And when you fail to pay the black tax, you are escorted with all sorts of blackmail around the circles. You will be described as a stingy man or woman. People will often wonder what it is that you do with your money. You will be ostracised in family gatherings. He who refuses to pay black tax enters the black book. They will look forward to your days of ‘failure’ to celebrate your return to grass. Stories will be told; “kale that woman used to be rich but now see. She was extravagant with her money. She failed to invest”. The same people you help will accuse you of failing to invest when things go sour.

The wedding collectors

Then there is a group that has made it a habit to enjoy all the luxuries on the sweat of other people. Do weddings hit people as a surprise? Do you wake up one day and just realise Joseph and Mary now want to stay together for the rest of their life? Do not attempt to attend a wedding meeting. You will be treated based on how much you can pay in black tax. From the chairman’s bag to buying a well-packaged pineapple for a ludicrous amount. Can’t people just live together in peace? Go to church, cook food at home and close the chapter?

Black tax: To pay or not to pay

There is no way out from black tax. You are damned if you pay it and you are damned if you do not. The threats border on lines of; “if you do not attend other people’s funerals, they won’t attend yours”. There is only one way out, find clever ways of dodging the tax. Do not over flaunt your achievements, fake some struggles, when the poor are crying about the economy, join them in their cries. Before people tell you about their problems, bombard them with your own problems. As Jesus hinted; “black tax you will always have with you. Don’t pay all of it.”

Twitter: ortegatalks

Don’t want to miss out on any story? For updates on all Sqoop stories, follow this link on Telegram: https://t.me/Sqoop